USD Coin Price Forecast for End of 2025: Detailed Analysis and Insights

This content is intended for educational purposes only and should not be considered financial advice. Investments in cryptocurrencies involve risks.

Introduction

As of August 20, 2025, 01:18 AM EEST, USD Coin (USDC) trades near $0.9998, holding the position of the second-largest stablecoin with a market cap of about $43.95 billion. Introduced in September 2018 by Centre Consortium—a partnership between Circle and Coinbase—USDC is a fully collateralized stablecoin pegged 1:1 to the US dollar, aimed at ensuring stability for transactions, trading, and DeFi. Its credibility is reinforced by monthly reserve audits performed by Grant Thornton LLP and wide support across networks such as Ethereum, Solana, and Polygon. This article examines USDC’s potential trajectory by the end of 2025, focusing on stability, growth drivers, and associated risks under evolving market and regulatory conditions.

Current Situation

As of August 20, 2025, USDC is priced at $0.9998 with a daily trading volume of $6.50 billion and a total market cap of $43.95 billion, ranking it 7th overall. Over the past month, volatility has stayed at just 0.02%, with a 0.01% drop in the last 24 hours, showcasing its peg stability. The Fear & Greed Index sits at 27.80, signaling extreme fear tied to market swings and regulatory pressures, including EU’s MiCA rules influencing stablecoins like Tether (USDT). USDC’s strong compliance record and transparent reserves help sustain trust, though prior stress events—such as March 2023’s temporary depeg—underline existing risks.

Price Predictions for End of 2025

Given its dollar peg, USDC is projected to remain close to $1.00 by December 2025, with minor shifts. Cautious outlooks from Bitget and DigitalCoinPrice suggest a narrow band of $0.9997–$1.00, aligned with its stablecoin mechanics. Slightly optimistic estimates, such as Kraken’s, place the price near $1.02, assuming steady adoption growth. More speculative forecasts like Gov Capital propose extreme scenarios of a surge to $5.50, though such outcomes are improbable given its reserve-backing. On the bearish side, WalletInvestor and CoinCodex anticipate potential declines to $0.823 or even as low as $0.0674, but these cases remain highly unlikely, considering USDC’s track record of maintaining its peg except under rare stress conditions.

Key Factors Supporting Stability

- Regulatory Compliance: Alignment with MiCA in the EU reinforces USDC’s credibility, especially while rivals like USDT face possible delistings.

- Broad Adoption: Usage across multiple blockchains (Ethereum, Arbitrum, Avalanche) and integration in DeFi, payments, and remittances increase demand.

- Transparency: Regular monthly audits by Grant Thornton LLP confirm full 1:1 backing, bolstering trust.

- Liquidity: Daily volume of $6.50 billion and its role as a trading pair across exchanges ensure steady demand.

- Institutional Support: Backing from Coinbase and Circle, along with initiatives like Circle Gateway, expand USDC’s reach and reliability.

Risks and Challenges

- Market Volatility: Severe downturns could lead to temporary depegs, as seen in March 2023, potentially pulling USDC below $0.95.

- Regulatory Pressure: Despite compliance, stricter global policies may restrict USDC’s usage in some areas, affecting growth.

- Counterparty Exposure: Reliance on custodians introduces risks like insolvency, though audits help reduce this risk.

- Competitive Landscape: Alternatives such as DAI or newer stablecoins could erode USDC’s dominance if they offer improved features.

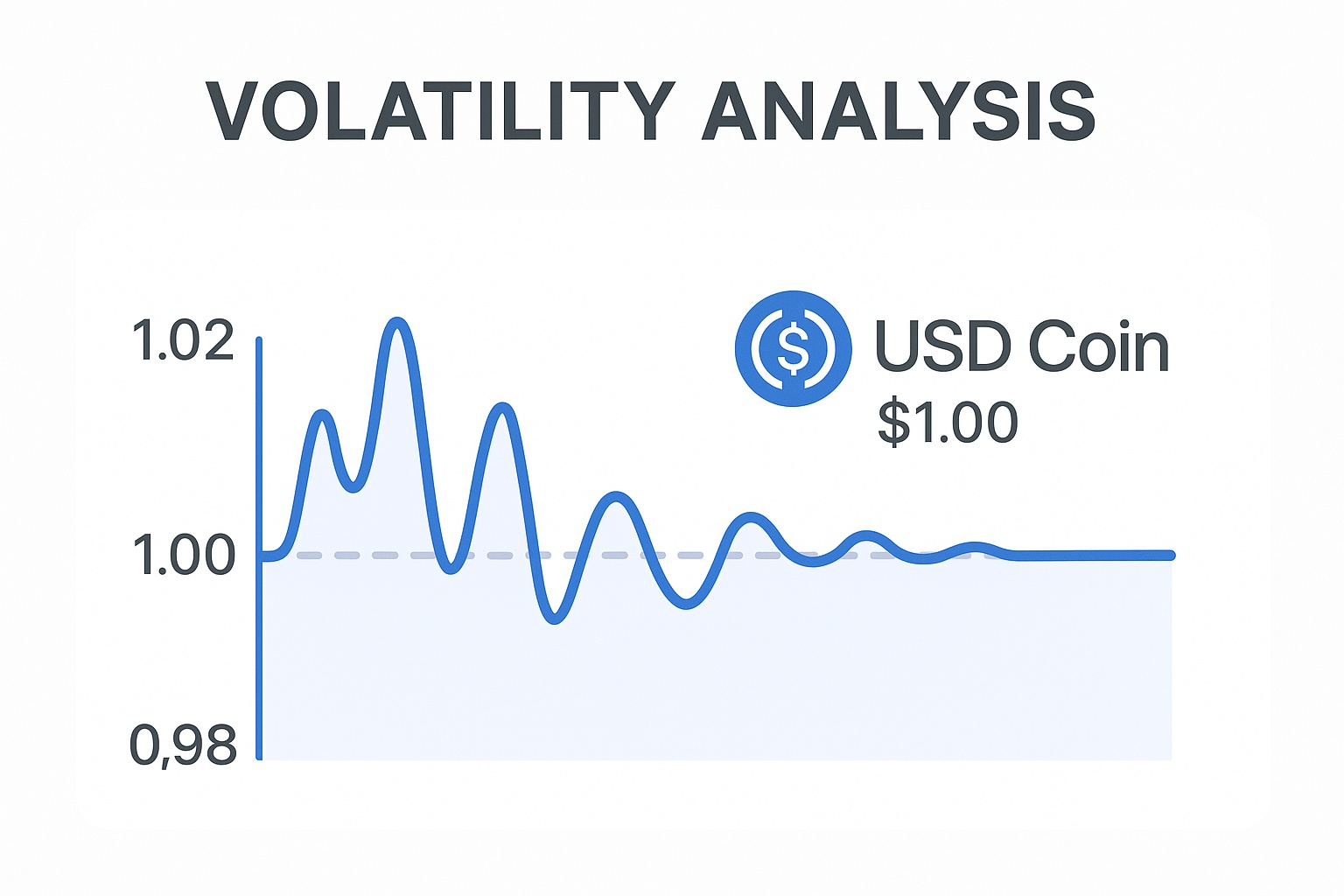

Volatility Analysis

Between July and August 2025, USDC remained steady in the $0.9997–$1.00 range, with volatility capped at 0.02%, consistent with its peg. While technical indicators are less relevant for stablecoins, on-chain data such as a Gini Index of 0.994 and 18.55 billion tokens moved indicate concentrated holdings and active circulation. USDC’s stability is further secured by its $43.95 billion supply and strong reserve support. Expanding DeFi activity and cross-chain adoption in 2025 could reinforce the peg around $1.00, though brief deviations of ±0.03% may occur during periods of stress, as Bitget projects.

Conclusion

By late 2025, USD Coin is anticipated to sustain its value within $0.9997–$1.02, with its stablecoin nature preventing large deviations from its $1.00 anchor. Factors such as compliance, ecosystem growth, and institutional backing enhance its outlook, while risks like market turbulence, regulatory shifts, and counterparty reliance remain. For investors, USDC should be viewed as a low-risk, value-preserving asset rather than a speculative opportunity, and proper due diligence is advised before engaging with stablecoins.