Tether Price Prediction for End of 2025: In-Depth Analysis and Insights

The information in this article is provided for educational purposes only and is not investment advice. Cryptocurrency investments carry risks.

Introduction

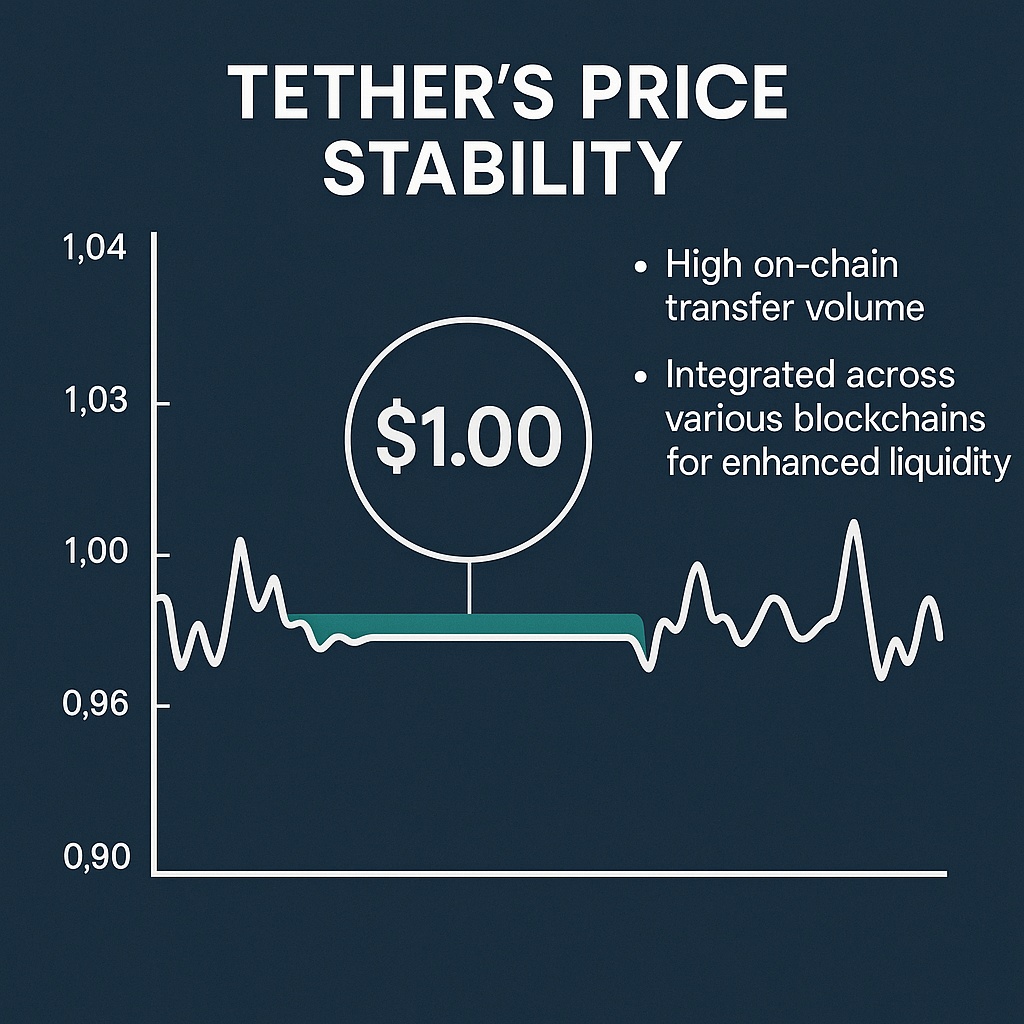

As of August 20, 2025, 01:18 AM EEST, Tether (USDT) is trading at approximately $1.00, maintaining its position as the leading stablecoin by market capitalization. Issued by Tether Limited, USDT is designed to maintain a 1:1 peg with the US dollar, providing stability in the volatile cryptocurrency market. Widely used in DeFi, trading, and cross-border transactions, Tether operates on multiple blockchains, including Ethereum, Tron, and Solana. This article provides a comprehensive analysis of USDT’s price outlook for the end of 2025, exploring its stability, adoption drivers, and potential risks based on current market trends and ecosystem developments.

Current Situation

As of August 20, 2025, Tether’s price remains stable at $1.00, with minor fluctuations within a 0.1–0.3% range over the past 30 days, reflecting its pegged design. With a market cap of approximately $120 billion and daily trading volumes exceeding $50 billion, USDT dominates the stablecoin market, accounting for over 60% of stablecoin trading volume. The Fear and Greed Index at 64 (Greed) reflects broader market optimism, indirectly supporting USDT’s utility as a safe haven during volatility. Over the past year, Tether’s circulating supply has grown by 15%, driven by demand in DeFi protocols, centralized exchanges, and emerging markets for remittances.

Price Predictions for End of 2025

Given Tether’s stablecoin nature, price predictions for USDT by December 2025 focus on its ability to maintain its $1.00 peg rather than speculative growth. Bearish scenarios suggest minor depegging to $0.98–$0.99 during extreme market stress or regulatory scrutiny, as seen briefly in 2022. Moderate projections expect USDT to remain at $1.00, supported by Tether Limited’s reserve backing and transparency efforts. Bullish scenarios are limited, but slight premiums of $1.01–$1.02 could occur in high-demand environments, such as a crypto bull run in Q1 2025. Analysts anticipate USDT’s market cap could grow to $140–$160 billion by year-end, reflecting increased adoption rather than price appreciation.

Factors Driving Stability and Adoption

- Stablecoin Dominance: Tether’s position as the most widely used stablecoin in crypto trading and DeFi ensures sustained demand.

- DeFi and Trading Utility: USDT’s integration in DeFi protocols and major exchanges like Binance and Coinbase drives high liquidity and usage.

- Cross-Border Transactions: Growing adoption in emerging markets for remittances and payments supports USDT’s circulating supply growth.

- Market Rally: A projected crypto bull run in Q1 2025 could increase demand for USDT as a stable trading pair and liquidity provider.

- Reserve Transparency: Tether Limited’s improved reserve attestations and audits enhance trust, mitigating past concerns about backing.

Risks and Downward Factors

- Regulatory Scrutiny: Ongoing global regulations targeting stablecoins could impose stricter reserve requirements or limit USDT’s accessibility.

- Depegging Risk: Extreme market volatility or loss of confidence in Tether’s reserves could cause temporary depegging below $1.00.

- Competition: Rival stablecoins like USDC, with stronger regulatory compliance, or central bank digital currencies (CBDCs) could erode USDT’s market share.

- Litigation Risks: Potential lawsuits or unresolved issues from Tether’s past transparency controversies could impact investor trust.

Volatility Analysis

From July to August 2025, Tether’s price has remained stable at $1.00, with volatility below 0.3%, reflecting its pegged design. Technical indicators are less relevant for USDT due to its stability, but its trading volume surged by 20% in Q2 2025, driven by increased DeFi activity and market volatility. The Relative Strength Index (RSI) is neutral at ~50, consistent with a stable asset. Tether’s market cap grew from $100 billion in August 2024 to $120 billion in August 2025, underscoring its growing adoption. A projected market recovery in Q1 2025 could further boost USDT’s circulating supply and liquidity, reinforcing its role as a cornerstone of the crypto ecosystem.

Conclusion

By the end of 2025, Tether’s price is expected to remain stable at $1.00, with minor fluctuations possible under extreme market conditions. Its market cap could grow to $140–$160 billion, driven by increased adoption in DeFi, trading, and cross-border payments. However, investors should remain cautious of regulatory scrutiny, competition from other stablecoins, and potential depegging risks. Thorough research and risk management are essential before using or holding Tether. Always consult financial experts to navigate the evolving stablecoin landscape.